How to Generate the BIR Form 1604-C

BIR Form 1604-C or Annual Information Return of Income Taxes Withheld on Compensation shall be filed by every employer or withholding agent/payor who is either an individual, estate, trust, partnership, corporation, government agency and instrumentality, government-owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees.

To Generate BIR form 1604-C, follow the steps below:

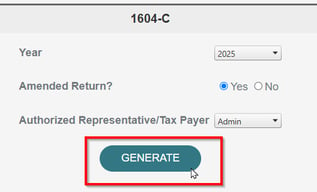

1. Go to Reports>BIR>1604-C.

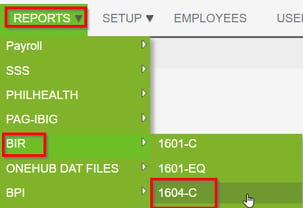

4. Fill out the necessary details then click Generate.

5. Print the generated pdf file.