ReadyCash Credit Line

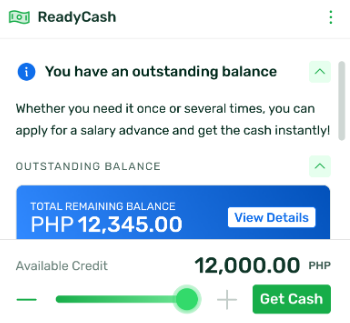

The Credit Line feature is designed to provide employees with greater flexibility by allowing them to access multiple loans, as long as they have sufficient credit available. This improvement removes the previous restriction of requiring full repayment before another loan request can be made.

How does it work?

1. Multiple Loan Access Within Credit Limit

Previously, employees were limited to one active loan at a time. With Credit Line, employees can now submit a new loan request even if they have an existing loan, provided they have enough unused credit remaining.

Example: If an employee has a credit limit of ₱10,000 and has already availed ₱6,000, they can request up to ₱4,000 without waiting for the current loan to be fully repaid.

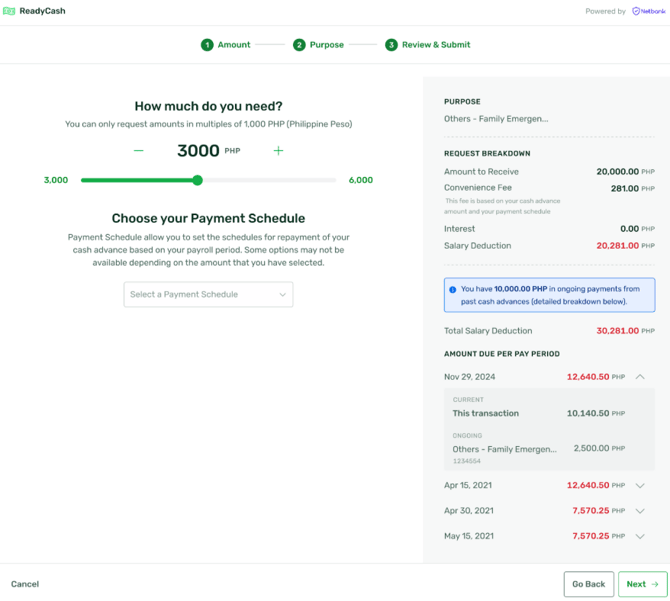

2. Enhanced Breakdown for Informed Borrowing

When applying for a new loan with an existing one still active, employees will be presented with a comprehensive breakdown that includes:

- Details of the current loan

- Breakdown of the new request

- Total expected deductions per payroll cycle

This enables employees to make informed decisions about whether they can manage an additional loan based on their existing obligations.

3. Adaptive Payment Terms Based on Loan Amount

Payment terms will now be dynamically offered based on the loan amount:

- For lower loan amounts, all available terms will be shown.

- For higher loan amounts, only longer-term options will be available, ensuring that repayment schedules remain reasonable and sustainable.

4. Repayment and Deduction Behavior

When using the Credit Line feature, it’s important to understand how deductions are handled, especially if you have more than one active loan at a time.

-

Deductions are scheduled per loan.

Each loan you avail under ReadyCash will follow its own repayment schedule based on the payment term you selected during application.

-

Multiple active loans may result in overlapping deductions.

If you apply for additional loans while a previous one is still being repaid, the corresponding deductions may run concurrently. This means your total payroll deduction per pay period may increase, depending on how many active loans you have at once.

We recommend reviewing the deduction breakdown presented during the application process to ensure you can manage multiple repayments within your salary range.

5. Credit Replenishment Policy

To maintain accurate credit tracking and prevent premature re-borrowing, credit replenishment will only occur once a loan is officially marked as Paid in the system.

Please note:

- A loan that has been deducted from an employee’s salary is not considered replenished.

- The credit limit will only be restored once the payment is fully processed and tagged as Paid in ReadyCash.

Rollout Notes:

- The Credit Line feature will initially be accessible only to employees who do not have any outstanding loans at the time of rollout.

- Employees with active loans will need to fully repay their existing obligations before they can use the Credit Line feature.