What Are Discretionary Deductions?

Discretionary deduction comprises of the Non-Taxable Allowance absent/late deduction. This is for presentation purposes only to easily identify if the allowance deduction is taxable or non-taxable but overall, there is no effect in the computation.

How does it look like in Payroll?

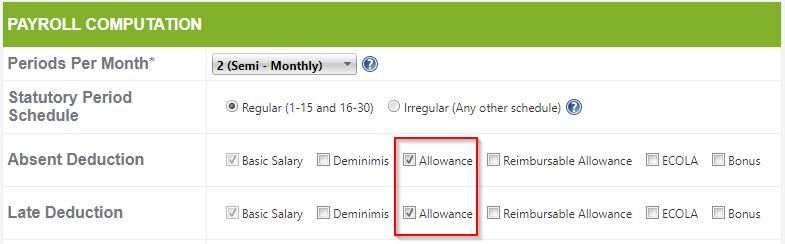

a) Check if Allowance is selected in Absent/Late deduction - Setup > Company > Profile > Payroll Computation

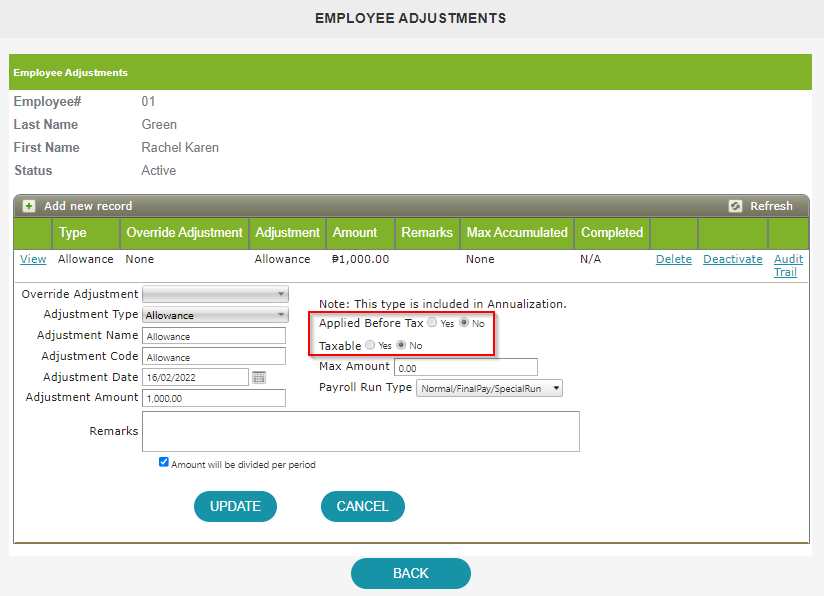

b) Check what kind of allowance is set up in the account of the employee - Employees tab > Select Employee Name > Click Adjustments

NOTE:

The below items should both be set to NO.

Applied Before Tax

Taxable

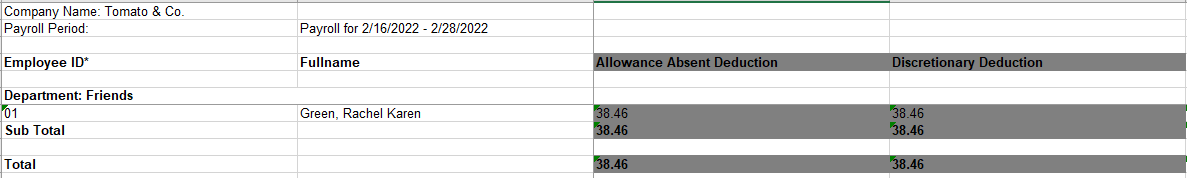

c) When you generate the Payroll Register in Reports > Payroll > Payroll Summary > Select Payroll > Export to Excel, it's the same amount shown under "Allowance Absent Deduction" in Payroll Register.

No worries, as this is just a display column and has no impact on payroll computation.

Want real-time responses? Explore Sprout Info, your 24/7 guide for product inquiries!