What to Do When a Worker’s Salary Varies and Government Contributions?

If there are instances an employee's salary varies per payroll but has fixed contributions, you may wonder when this happens. An example would be when the employee is paid per invoice so the salary differs every cut-off.

Reminder: It would still depend on the company's setup or policies and as such, the scenario is not fixed.

The next question would be, 'Can we process it in Sprout Payroll?'. The answer to this question is yes, we may have a workaround to cater to this type of setup, and here's what we can recommend:

1. Set the basic salary of the employee to 0.

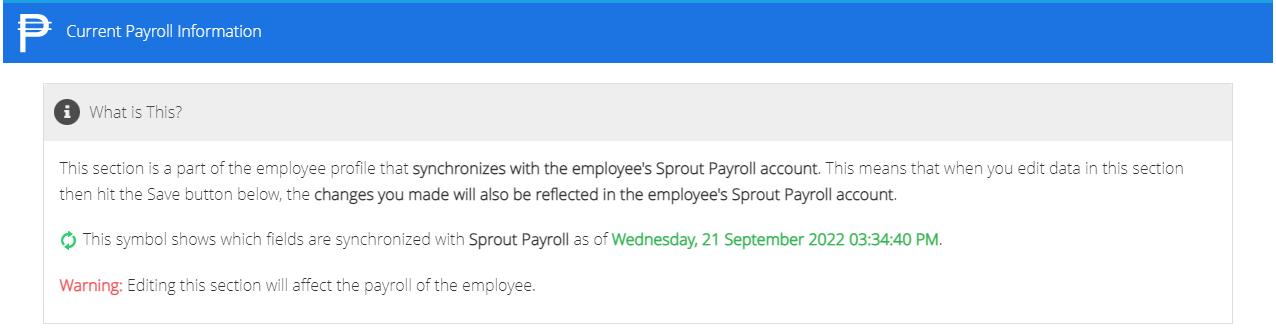

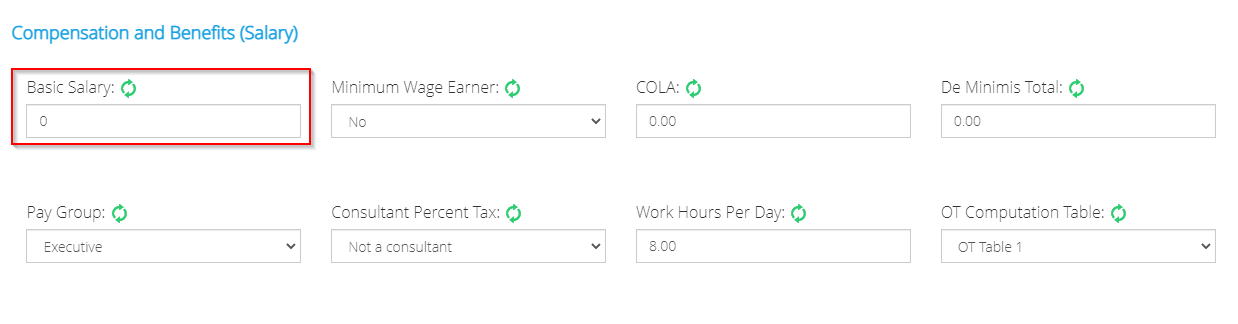

- For Full Sync accounts - the changes are done in Sprout HR.

Employee Profile > Current Payroll Information

Compensation and Benefits (Salary) > Basic Salary

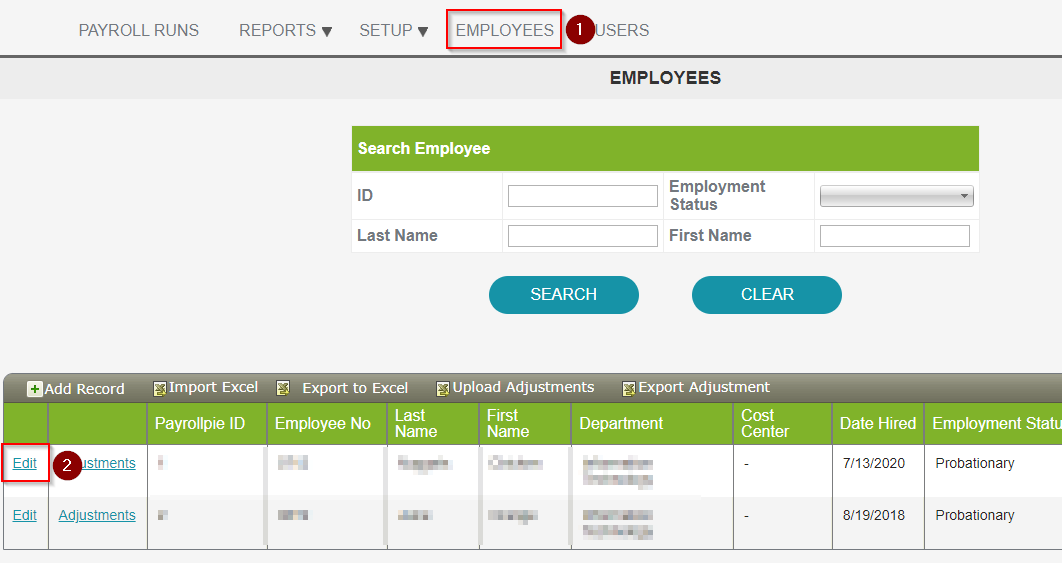

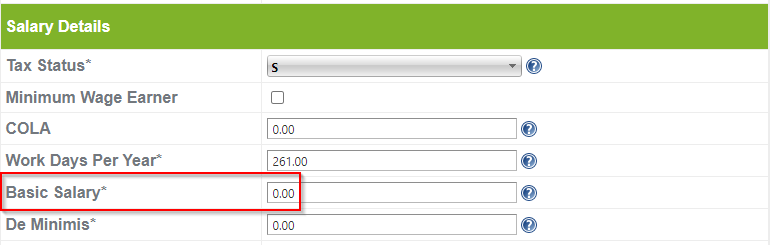

- For Partial Sync - the changes are done in Sprout Payroll.

Employees > Edit

Salary Details > Basic Salary

Note: Full sync accounts have a green syncing icon (![]() ) as an indicator.

) as an indicator.

2. Upload a one-time adjustment for the employee's salary basic/salary adjustment type.

![]()

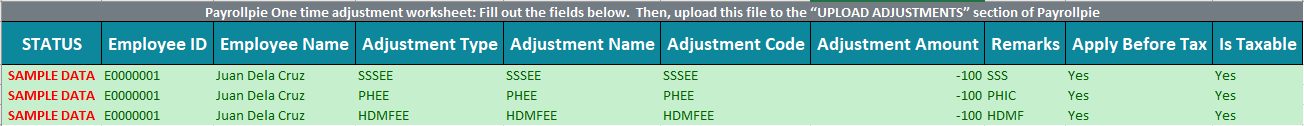

3. Manually upload the government contributions such as SSS, PHIC, and HMDF Contributions.

- SSS: Use SSSEE as the Adjustment Type (Employee Contribution) - The amount must be in negative value since this is a deduction.

- PHIC: Use PHEE as the Adjustment Type (Employee Contribution) - The amount must be in negative value since this is a deduction.

- For HDMF: Use HMDFEE as the Adjustment Type (Employee Contribution) - The amount must be in negative value since this is a deduction.

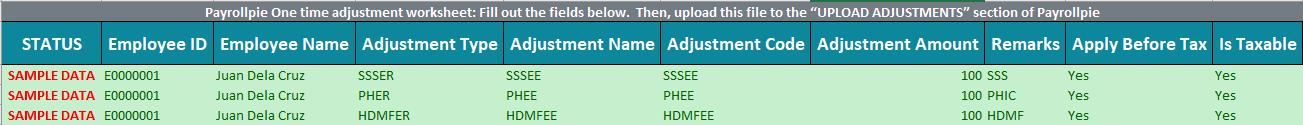

3. Lastly, make sure to upload SSSER and SSSEC, PHER, and HDMFER for the employer contribution. The amount must be in positive value.

Want real-time responses? Explore Sprout Info, your 24/7 guide for product inquiries!