Why is the Resigned Daily Paid Employee not Reflecting in the Final Pay - Part Time Run?

For part-time, daily, and hourly employees, the regular payroll run type is "Part Time." Consequently, the Final Payroll run type should be labeled as "Final Pay - Part Time."

However, there are instances where the final pay for resigned daily paid employees is not reflected in the Final Pay - Part-Time payroll run. One key prerequisite for creating a Final Payroll run for part-time employees is the existence of a "Part-Time Payroll run."

But don’t worry! The final pay for daily-paid employees will still be included in the normal Final Pay. Just ensure that the "from" and "to" dates cover the period of separation for the resigned daily-paid employees.

Regarding the computation, since this is a final pay for semi-monthly employees, you have two options. (1) You may convert the Basic Salary and the De Minimis (if any) from Daily Rate to Monthly Rate.

To convert here's the formula:

Basic Monthly Rate = (Daily Rate x Work Days Per Year)\ 12 months13,050 = (600 x 261)\12

De Minimis = (Daily Rate x Work Days Per Year)\ 12 months2,175 = (100 x 261)\12

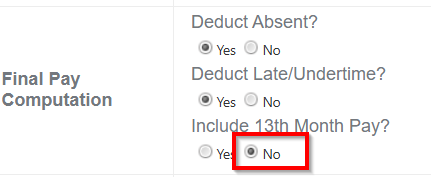

Alternatively, (2) You may set the final pay options to "Do not include." For all earnings and deductions, such as:

- Basic Pay

- Overtimes

- 13th - Month Pay

- Other Allowances

And that's it! Final Pay of resigned Daily Paid Employees is now processed!

Related Article: Adjustment Types on Sprout Payroll

Want real-time responses? Explore Sprout Info, your 24/7 guide for product inquiries!